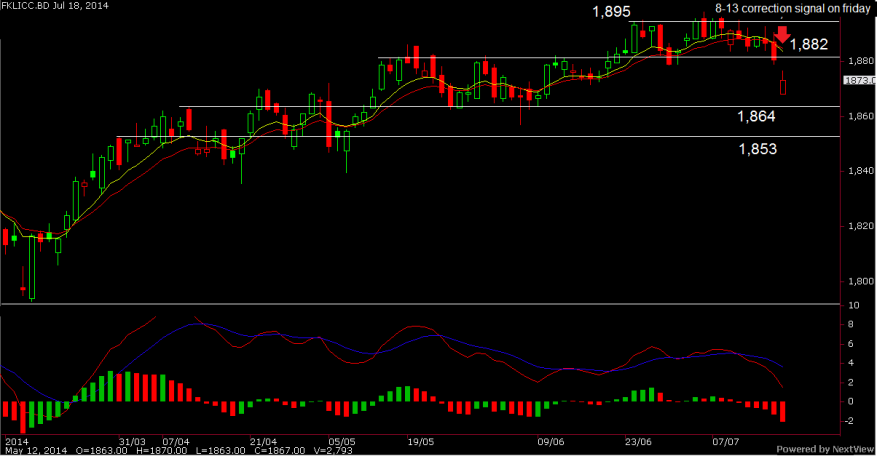

[FKLI]

As anticipated in Issue #22, FKLI did have a strong rally and subsequently hit our 1st rally target 1,874 on Wednesday. The prices eventually unable to stay above 1,874 and instead close at 1,866 and therefore I anticipate that the market might have a correction towards 1,854. Kindly refer the trading plans below to be well prepared for next week:

Plan A:

FKLI resume rally if EMA 8 above EMA 13 + prices above 1,864

1st resistance /rally target is 1,874, while 2nd resistance/rally target is 1,882

Plan B:

FKLI resumes correction + daily closing prices stay below 1,864

1st support/ correction target is 1,854, 2nd support/correction target is 1,844

Want more trade ideas? I publish members only daily trade setups on FKLI & FCPO. Register here to be part of the community.

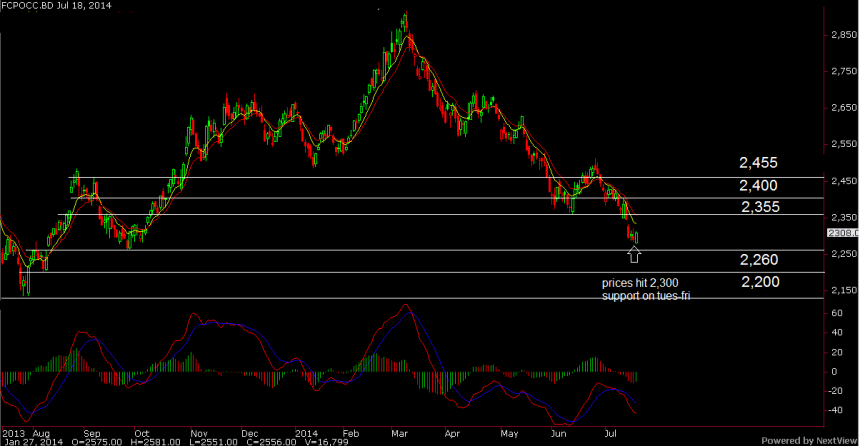

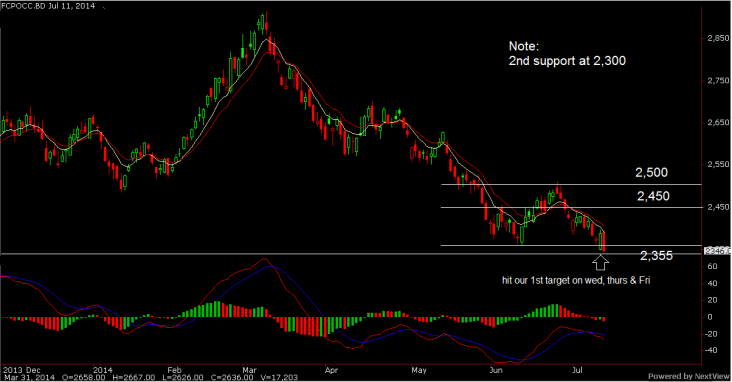

[FCPO]

FCPO again resumed its correction and subsequently hit Issue #22 2nd support target of 2,000 last Friday closing. According to the latest chart figures we could see FCPO continue its downtrend in the coming weeks. That being said, observe the following plans below to be well prepared for next week:

Plan A:

FCPO start a rally if 8 EMA above 13 EMA + price above 2,150

1st resistance/ rally target is 2,200; 2nd resistance/ rally target is 2,260

Plan B:

In contrasts, FCPO resume correction if 8 EMA below 13 EMA + prices below 2,000

1st support/ correction target is 1,950; 2nd support/ correction target 1,900

Want more trade ideas? I publish members only daily trade setups on FKLI & FCPO. Register here to be part of the community.

[DOW FUTURES]

The DOW Futures did have a rally throughout last week, anticipated in Issue #22. Observe the following scenarios below for next week:

Plan A:

Dow Futures starts a rally if 8 EMA above 13 EMA + prices above 17,000

1st resistance/ rally target at 17,200; 2nd resistance/ rally target at 17,400

Plan B:

In contrast, DOW Futures starts a correction if 8 EMA below 13 EMA + prices below 16,800

1st support/ correction target at 16,600; 2nd support/ correction target at 16,400

[S&P 500 FUTURES]

S&P Futures last week triggered our Issue #22 Plan A and prices eventually had a rally towards Issue #22 1st rally target of 1,980. That being said, observe the following scenarios below for next week:

Plan A:

S&P Futures resume rally if 8 EMA above 13 EMA + prices above 1,980

1st resistance/ rally target 2,000; 2nd resistance/ rally target at 2,020

Plan B:

In contrast, S&P Futures starts a correction if 8 EMA below 13 EMA + prices below 1,960

1st support/ correction target at 1940; 2nd support/ correction target at 1,920

DISCLAIMER

The opinions and information contained herein are based on available data believed to be reliable and for educational purposes only. It is not an offer or solicitation to buy or sell the securities covered by this outlook. No individual financial strategy or goals have been taken into account in the preparing of outlooks. Readers should seek independent advice from author for detailed analysis and strategies.

About David Lee

David Lee is a futures Trend Follower, contributing speaker for Futures Market Outlooks.com & Trend Following Malaysia. He believes anyone can easily follow price trends IF they know how to see the big picture. Hence his mission is to introduce futures trend following strategies to the general public so traders can complement their existing strategies to trade differently compared to the rest. You can contact David Lee here.